UPMC’s close attention to quality and costs has yielded tangible returns in the financial markets, as reflected in its credit ratings from all three major rating agencies: Moody’s Ratings, Standard & Poor’s (S&P), and Fitch Ratings.

Moody's

On March 10, 2025, Moody’s Ratings (Moody’s) affirmed UPMC’s ‘A2’ revenue bond rating and stable outlook. The affirmation of the ‘A2’ and stable outlook reflects UPMC’s critical role in the region’s healthcare delivery network, which helped secure meaningful rate increases from the Commonwealth that will enable materially improved financial performance in 2025, supporting consolidated operating cash flow margins in the low single-digit range and UPMC’s ability to fund capital while maintaining unrestricted liquidity. The rating affirmation balances UPMC’s clinical breadth and substantial market share in its provider and payor markets, ensuring the system’s essentiality and driving strong utilization against operational headwinds.

Standard & Poor’s

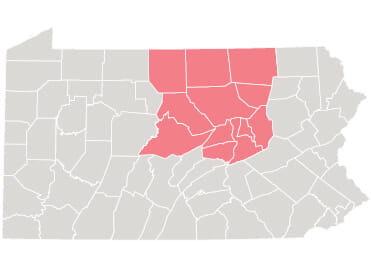

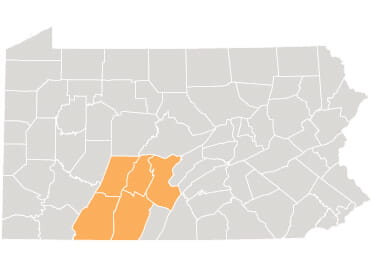

On March 7, 2025, S&P Global Ratings affirmed its ‘A’ long-term rating and underlying rating (SPUR) on debt issued by various authorities for UPMC and on UPMC’s taxable debt; and affirmed its stable outlook. The affirmation reflects strategic benefits associated with UPMC’s large and diversified provider network and insurance business that, together with the organization’s employed physicians, operate as an integrated delivery and financing system. The stable outlook reflects UPMC’s enterprise profile, with ample geographic diversity and its substantial market presence, as stabilizing rating factors.

Fitch Ratings

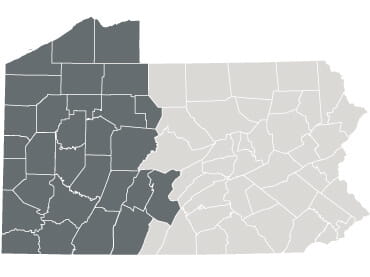

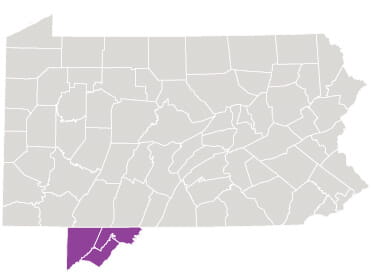

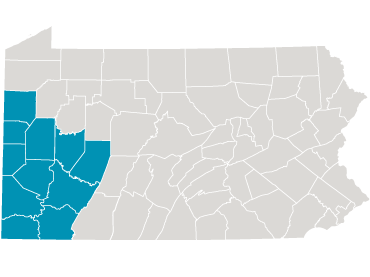

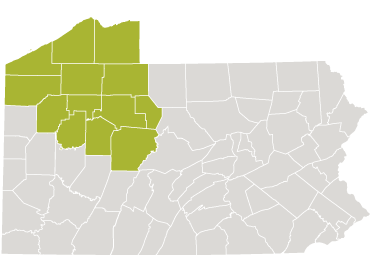

On March 6, 2025, Fitch Ratings affirmed UPMC’s revenue bond rating of ‘A’ and revised the outlook from stable to negative. The ‘A’ rating affirmation is based on UPMC’s leading market share position in its core markets of western Pennsylvania and UPMC’s significant level of revenue diversity in several markets across Pennsylvania and adjoining western New York and northwest Maryland, further supported by UPMC’s large insurance division, providing some revenue predictability. The revised outlook reflects two years of significant operating losses, leading to break-even operating cash flow and slightly weaker liquidity metrics. Management aims to return the system to profitability in 2025 by leveraging improved Medicaid rates and continuing to implement efficiency and margin initiatives, targeting significant improvements with the expectation for incrementally better operating EBITDA margins over the five-year forward look.

About UPMC

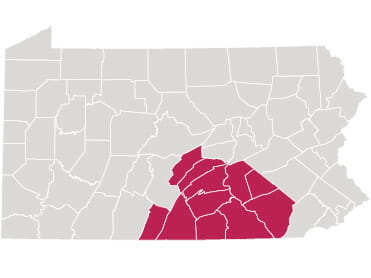

UPMC is a world-renowned, nonprofit health care provider and insurer committed to delivering exceptional, people-centered care and community services. Headquartered in Pittsburgh and affiliated with the University of Pittsburgh Schools of the Health Sciences, UPMC is shaping the future of health through clinical and technological innovation, research, and education. Dedicated to advancing the well-being of our diverse communities, we provide nearly $2 billion annually in community benefits, more than any other health system in Pennsylvania. Our 100,000 employees — including more than 5,000 physicians — care for patients across more than 40 hospitals and 800 outpatient sites in Pennsylvania, New York, and Maryland, as well as overseas. UPMC Insurance Services covers more than 4 million members, providing the highest-quality care at the most affordable price. To learn more, visit UPMC.com.